Introduction

In today’s technology driven business environment, the interplay between technical and non-technical roles is crucial for the success of many companies, particularly in industries heavily reliant on IT. As companies increasingly depend on technology, the question arises: Should IT staff be managed by non-technical people, or is it more effective to have IT professionals who possess strong business acumen?

The question of whether non-technical people should manage IT staff is a significant one, as the answer can impact the efficiency and harmony of operations within an organisation. This blog post delves into the perspectives of both IT staff and business staff to explore the feasibility and implications of such managerial structures.

Understanding the Roles

IT Staff: Typically includes roles such as software developers, data and analytics professionals, system administrators, network engineers, and technical support specialists. These individuals are experts in their fields, possessing deep technical knowledge and skills.

Business Staff (Non-Technical Managers): Includes roles like cleint account managers, project managers, team leaders, sales, marketing and human resources and other managerial positions that may not require detailed technical expertise but focus on project delivery, client interaction, and meeting business objectives.

Undeniably, the relationship between technical and non-technical roles is pivotal but there are different perspectives on who is best suited to manage technical staff which introduces specific challenges but also benefits and advantages to the business as a whole.

Perspectives on Non-Technical Management of IT Staff

IT Staff’s Point of View

Challenges:

- Miscommunication: Technical concepts and projects often involve a language of their own. Non-technical managers may lack the vocabulary and understanding needed to effectively communicate requirements or constraints to their IT teams.

- Mismatched Expectations: Without a strong grasp of technical challenges and what is realistically achievable, non-technical managers might set unrealistic deadlines or fail to allocate sufficient resources, leading to stress and burnout among IT staff.

- Inadequate Advocacy: IT staff might feel that non-technical managers are less capable of advocating for the team’s needs, such as the importance of technical debt reduction, to higher management or stakeholders.

Benefits:

- Broader Perspective: Non-technical managers might bring a fresh perspective that focuses more on the business or customer impact rather than just the technical side.

- Enhanced Focus on Professional Development: Managers with a non-technical background might prioritize soft skills and professional growth, helping IT staff develop in areas like communication and leadership.

Business Staff’s Point of View

Advantages:

- Focus on Business Objectives: Non-technical managers are often more attuned to the company’s business strategies and can steer IT projects to align more closely with business goals.

- Improved Interdepartmental Communication: Managers without deep technical expertise might be better at translating technical jargon into business language, which can help bridge gaps between different departments.

Challenges:

- Dependency on Technical Leads: Non-technical managers often have to rely heavily on technical leads or senior IT staff to make key decisions, which can create bottlenecks or delay decision-making.

- Potential Underestimation of Technical Challenges: There’s a risk of underestimating the complexity or time requirement for IT projects, which can lead to unrealistic expectations from stakeholders.

Best Practices for Non-Technical Management of IT Teams

- Education and Learning: Non-technical managers should commit to learning basic IT concepts and the specific technologies their team works with to improve communication and understanding.

- Hiring and Leveraging Technical Leads: Including skilled technical leads who can act as a bridge between the IT team and the non-technical manager can mitigate many challenges.

- Regular Feedback and Communication: Establishing strong lines of communication through regular one-on-ones and team meetings can help address issues before they escalate.

- Respecting Expertise: Non-technical managers should respect and trust the technical assessments provided by their team, especially on the feasibility and time frames of projects.

The Role of IT Professionals with Strong Business Acumen and Commercial Awareness

The evolving landscape of IT in business settings, has begun to emphasise the importance of IT professionals who not only possess technical expertise but also a strong understanding of business processes and commercial principles – technology professionals with financial intelligence and a strong commercial awareness. Such dual-capacity professionals can bridge the gap between technical solutions and business outcomes, effectively enhancing the strategic integration of IT into broader business goals.

Advantages of IT Staff with Business Skills

- Enhanced Strategic Alignment: IT professionals with a business acumen can better understand and anticipate the needs of the business, leading to more aligned and proactive IT strategies. They are able to design and implement technology solutions that directly support business objectives, rather than just fulfilling technical requirements.

- Improved Project Management: When IT staff grasp the broader business impact of their projects, they can manage priorities, resources, and timelines more effectively. This capability makes them excellent project managers who can oversee complex projects that require a balance of technical and business considerations.

- Effective Communication with Stakeholders: Communication barriers often exist between technical teams and non-technical stakeholders. IT staff who are versed in business concepts can translate complex technical information into terms that are meaningful and impactful for business decision-makers, improving decision-making processes and project outcomes.

- Better Risk Management: Understanding the business implications of technical decisions allows IT professionals to better assess and manage risks related to cybersecurity, data integrity, and system reliability in the context of business impact. This proactive risk management is crucial in protecting the company’s assets and reputation.

- Leadership and Influence: IT professionals with strong business insights are often seen as leaders who can guide the direction of technology within the company. Their ability to align technology with business goals gives them a powerful voice in strategic decision-making processes.

Cultivating Business Acumen within IT Teams

Organizations can support IT staff in developing business acumen through cross-training, involvement in business operations, mentorship programs, and aligning performance metrics with business outcomes.

- Training and Development: Encouraging IT staff to participate in cross-training programs or to pursue business-related education, such as MBA courses or workshops in business strategy and finance, can enhance their understanding of business dynamics.

- Involvement in Business Operations: Involving IT staff in business meetings, strategy sessions, and decision-making processes (appart form being essential to be succesful in technology delivery alignment) can provide them with a deeper insight into the business, enhancing their ability to contribute effectively.

- Mentorship Programs: Pairing IT professionals with business leaders within the organization as mentors can facilitate the transfer of business knowledge and strategic thinking skills.

- Performance Metrics: Aligning performance metrics for IT staff with business outcomes, rather than just technical outputs, encourages them to focus on how their roles and projects impact the broader business objectives.

The Dynamics of Managing IT Staff: Non-Technical Managers vs. Tech-Savvy Business Leaders

In the intricate web of modern business operations, the relationship between technical and non-technical roles is crucial. This article explores both scenarios, highlighting the perspectives of IT and business staff, along with the advantages of having tech-savvy business leaders within IT.

Conclusion

Whether non-technical managers or IT staff with strong business acumen should lead IT teams depends largely on their ability to understand and integrate technical and business perspectives. Effective management in IT requires a balance of technical knowledge and business insight, and the right approach can differ based on the specific context of the organisation. By fostering understanding and communication between technical and non-technical realms, companies can harness the full potential of their IT capabilities to support business objectives.

IT professionals who develop business acumen and commercial awareness can significantly enhance the value they bring to their organisations. By understanding both the technical and business sides of the equation, they are uniquely positioned to drive innovations that are both technologically sound and commercially viable. This synergy not only improves the effectiveness of IT enablement but also elevates the strategic role of IT within the organisation.

A good book on the topic: “What the numbers mean” by Renier Botha

As more and more companies become increasingly digitally driven, the trend is that smart companies are investing more in their digital strategies and the conversion of technology innovation into revenue earning products and services.

Leading businesses in this technology age, will be the technologist, the IT leaders of today is becoming the business leaders of the future.

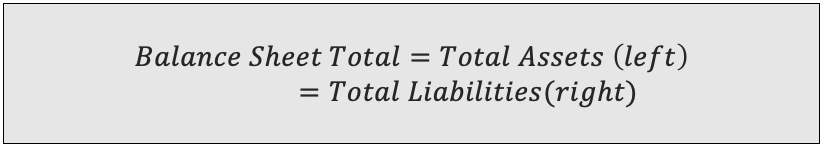

This book provides a concise overview of the most important financial functions, statements, terms, practical application guidelines and performance measures.

You’ll learn the value that commercial awareness and financial intelligence bring to setting strategy, increasing productivity and efficiency and how it can support you in making more effective decisions.