How Data Can Inform Top Board Priorities for 2025

As businesses navigate an increasingly complex landscape, data-driven decision-making is critical for boards looking to stay ahead.

The percentages cited for these top 15 board priorities are based on research conducted by the National Association of Corporate Directors (NACD), as part of their 2024 Board Trends and Priorities Report, which identifies the key issues expected to shape boardroom agendas in 2025. This research reflects input from board members across various industries, offering a comprehensive view of the strategic, operational, and risk-related concerns that will demand board attention in the year ahead.

The percentages shown next to each of the top 15 board priorities represent the proportion of board members who identified each issue as a critical focus area for 2025. These figures reflect the varying levels of concern and strategic emphasis boards are placing on different challenges. For example, 78% of boards prioritize growth strategies, making it the most pressing focus, while 47% highlight M&A transactions and opportunities, and 43% emphasize both CEO/C-suite succession and financial conditions and uncertainty. Other areas like competition (31%), product/service innovation (30%), and digital transformation (29%) also feature prominently. Cybersecurity and data privacy concerns (27%) remain significant, while business continuity (18%), regulatory compliance (17%), and workforce planning (14%) reflect ongoing operational and risk considerations. Less frequently cited, but still noteworthy, are shareholder engagement (11%), executive compensation (8%), and environmental/sustainability strategy (7%). The remaining 3% represents other emerging issues boards anticipate addressing in 2025. These percentages provide insight into the collective mindset of corporate leadership, illustrating the diverse and evolving priorities shaping governance in the year ahead.

The top board priorities for 2025 reflect a blend of strategic growth, risk management, and operational resilience.

Here’s how data can provide valuable insights across these key areas:

1. Growth Strategies (78%)

Data analytics helps boards identify emerging markets, customer behavior trends, and competitive advantages. By leveraging market intelligence, businesses can optimize pricing strategies, expand into new regions, and tailor their product offerings. Predictive analytics can also forecast demand and identify high-growth segments.

2. M&A Transactions and Opportunities (47%)

Boards can use financial modeling and risk assessment tools to evaluate potential mergers and acquisitions. Data-driven due diligence, including AI-powered sentiment analysis and real-time financial metrics, helps assess the value and risks of potential deals.

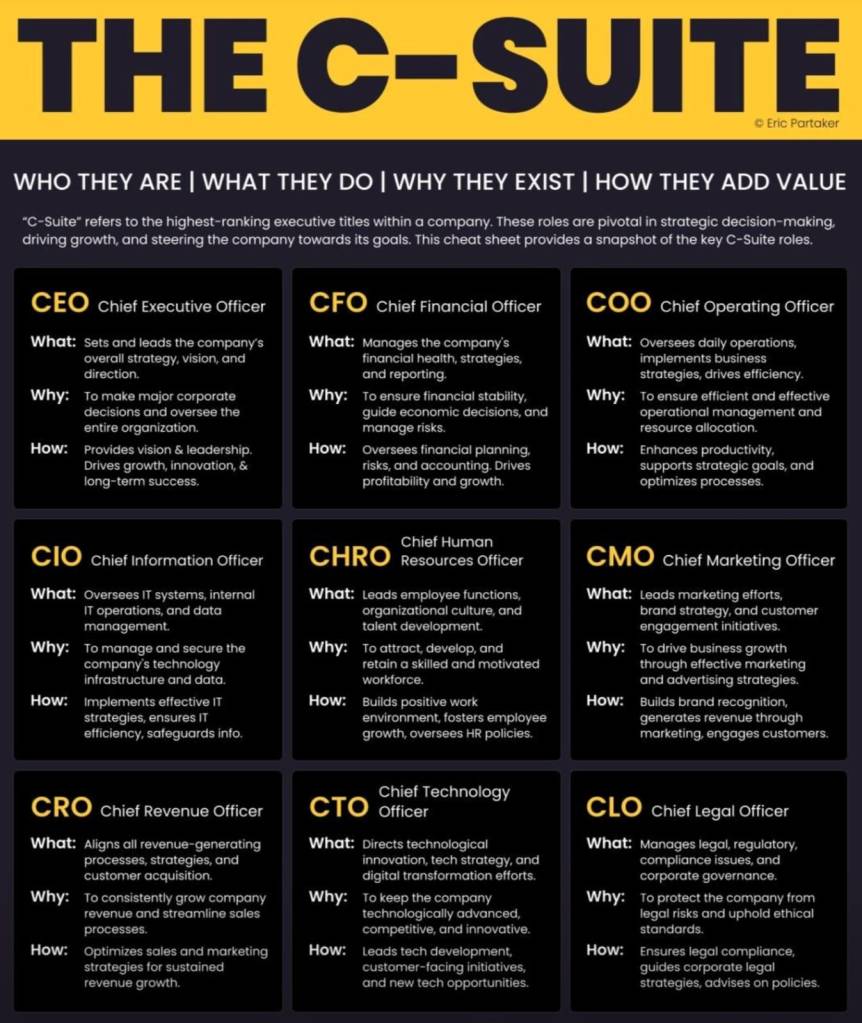

3. CEO/C-Suite Succession (43%)

HR analytics can track leadership performance, identify high-potential candidates, and assess cultural fit. Predictive modeling can also help boards anticipate leadership gaps and prepare for smooth transitions.

4. Financial Conditions and Uncertainty (43%)

Real-time financial data, scenario modeling, and macroeconomic indicators can help boards navigate uncertainty. Machine learning models can predict cash flow trends, economic downturns, and investment risks, ensuring proactive financial planning.

5. Competition (31%)

Competitive intelligence tools analyze market trends, pricing strategies, and customer sentiment to keep businesses ahead. Social listening and web scraping can provide insights into competitor moves and consumer preferences.

6. Product/Service Innovation (30%)

Customer feedback, AI-driven R&D insights, and market analytics guide product development. Data-driven innovation strategies ensure companies invest in solutions that meet evolving consumer demands.

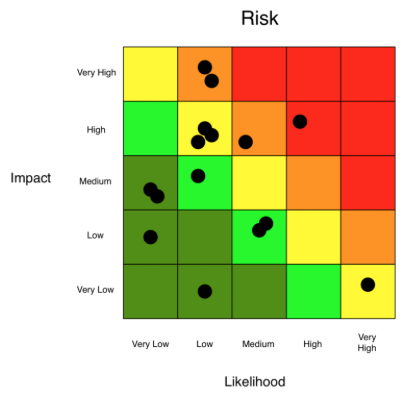

7. Digital Transformation (Including AI Risks) (29%)

AI-driven automation, cloud computing, and data analytics enhance efficiency, but boards must assess AI-related risks such as bias, compliance, and cybersecurity vulnerabilities. AI governance frameworks based on data insights can help mitigate these risks.

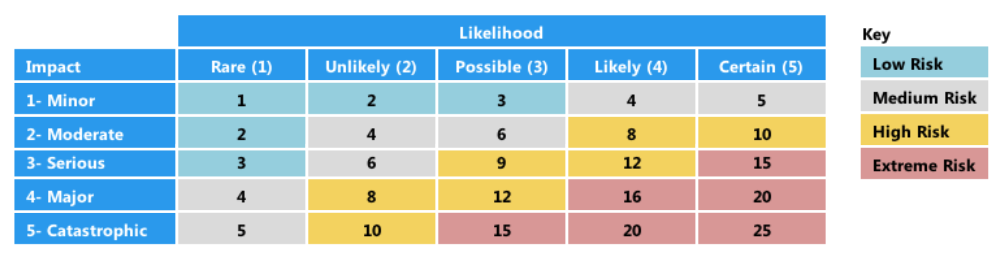

8. Cybersecurity/Data Privacy (27%)

Boards can use threat intelligence, anomaly detection, and predictive analytics to assess and mitigate cybersecurity threats. Data encryption, compliance monitoring, and real-time breach detection enhance security postures.

9. Business Continuity/Crisis Management (18%)

Predictive analytics and scenario planning enable organizations to anticipate disruptions. Real-time monitoring and data-driven contingency planning improve crisis response.

10. Regulatory Compliance (17%)

Data-driven compliance tracking ensures businesses meet evolving regulations. AI-powered monitoring tools flag potential violations and streamline reporting processes.

11. Workforce Planning (14%)

HR analytics track workforce trends, skills gaps, and employee engagement. Predictive modeling aids in talent retention and future workforce planning.

12. Shareholder Engagement/Activism (11%)

Sentiment analysis and shareholder data provide insights into investor concerns. Data-driven communication strategies enhance shareholder relations and transparency.

13. Executive Compensation (8%)

Benchmarking tools use industry data to inform fair and performance-based compensation structures. Data-driven compensation models ensure alignment with company goals and shareholder expectations.

14. Environmental/Sustainability Strategy (7%)

Sustainability metrics, ESG (Environmental, Social, and Governance) data, and carbon footprint tracking guide eco-friendly business strategies. Data transparency helps align sustainability efforts with regulatory and investor expectations.

15. Other Priorities (3%)

Boards can use custom data solutions tailored to specific business challenges, ensuring agility and informed decision-making across all functions.

Final Thoughts

Data is the cornerstone of effective board governance. In 2025, organizations that harness real-time insights, predictive analytics, and AI-driven decision-making will be best positioned to navigate challenges and seize opportunities. Boards must prioritize data-driven strategies to stay competitive, resilient, and future-ready.